- Features

- Solutions

- Pricing

- Resources

- Contact

- Book a demo

Billing is probably one of the toughest challenges coworking space managers have to face every day. It involves plenty of aspects that may become really time-consuming at times. You need to keep records of all products and services a flexible workspace provides, create members’ accounts, generate invoices, then make sure that residents get your payment statements and actually pay their membership fees.

An experienced community manager can surely cope with billing operations especially when a workspace is small and you know each of your 40 members personally. However, things turn into a nightmare when you start to grow, branch out, or say you are running large, multi-location business centers with multiple private offices, huge office spaces, and manage coworking communities of 500+ members.

It’s absolutely impossible for a coworking space operator to handle administrative tasks such as billing operations on a spreadsheet. What if you make a mistake in a member’s name, email, etc? How many hours will you spend on troubleshooting? How much will this inaccuracy cost to your brand image?

Luckily, you don’t have to process all your bills and online payments manually. In this article, I am going to tell you how to automate billing at your coworking space and make payments as convenient as possible for residents on Spacebring example.

Automated Billing at a Coworking Space: How It Works

If you want to make some tedious process fast and effortless—automate it. This is exactly what Spacebring coworking space software does for your billing (as well as desk and room bookings, and other services).

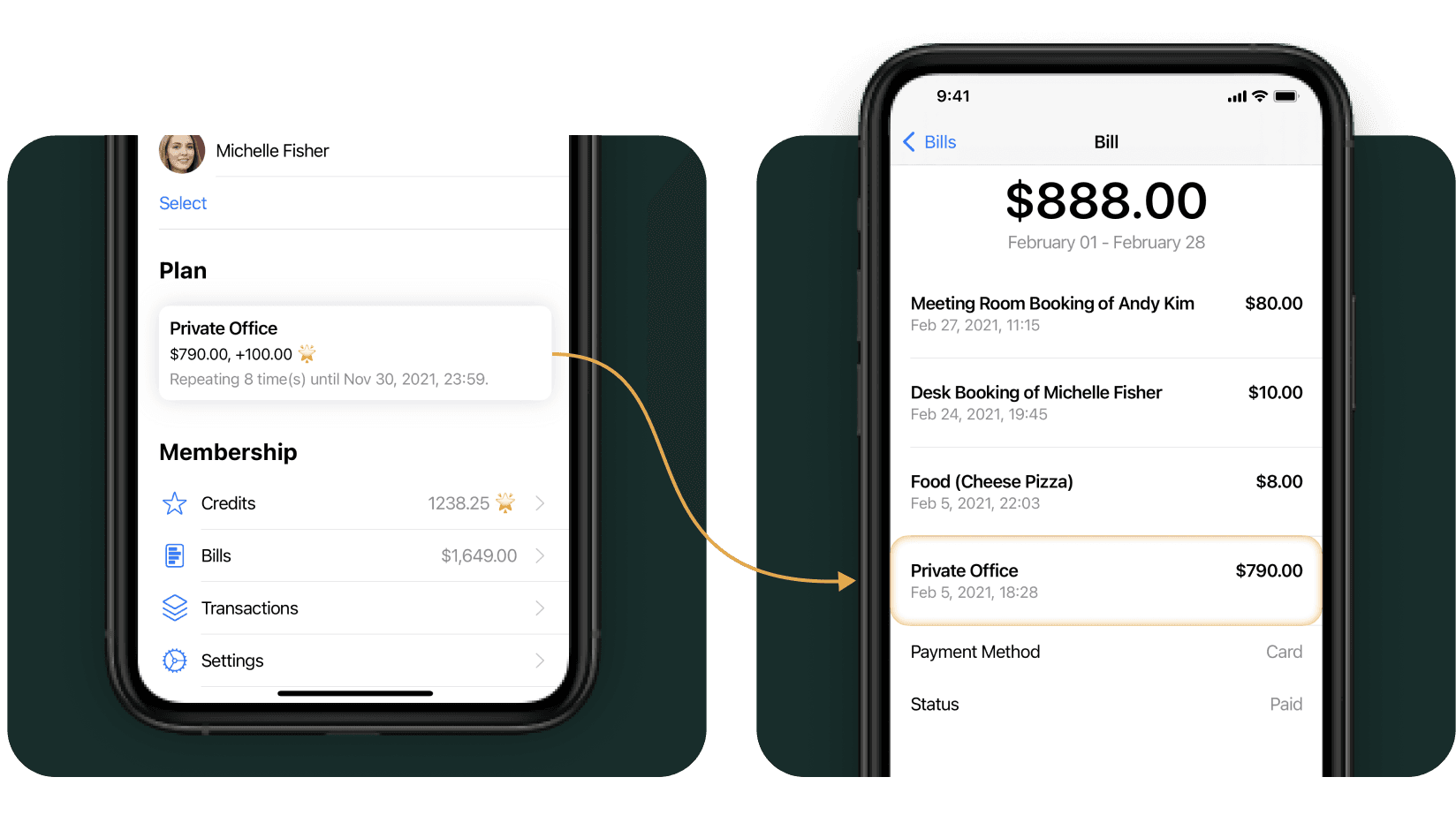

You just assign a membership plan to a company or an individual member once and the system will automatically create bills and include all recurring, one-off, and usage-based fees.

Plan name will be used for the recurring bill item added from the pre-assigned membership plan

- A recurring fee is a single membership plan price that you charge on a recurring daily, weekly, or monthly basis.

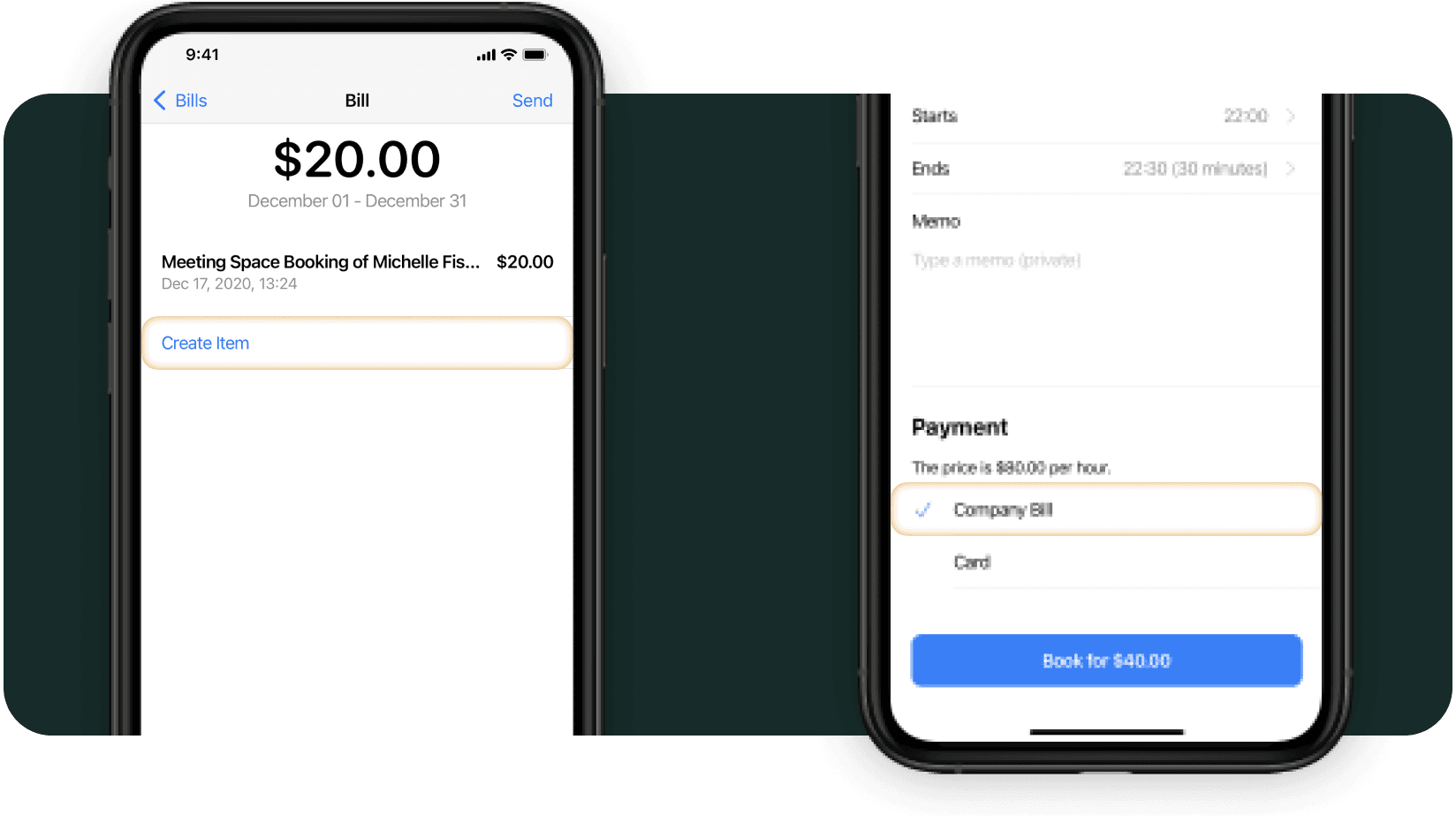

- A one-off fee is charged for one-time purchases and can be added manually.

The administrator clicks ‘Create Item’ to add additional fees to the total upcoming bill. ‘Company Bill’ is a payment method team members choose when they run out of meeting room booking credits or buy additional services to be paid by company managers at the end of the month.

- Usage-based fees are charged for conference room bookings/desk bookings and services paid for by a company bill.

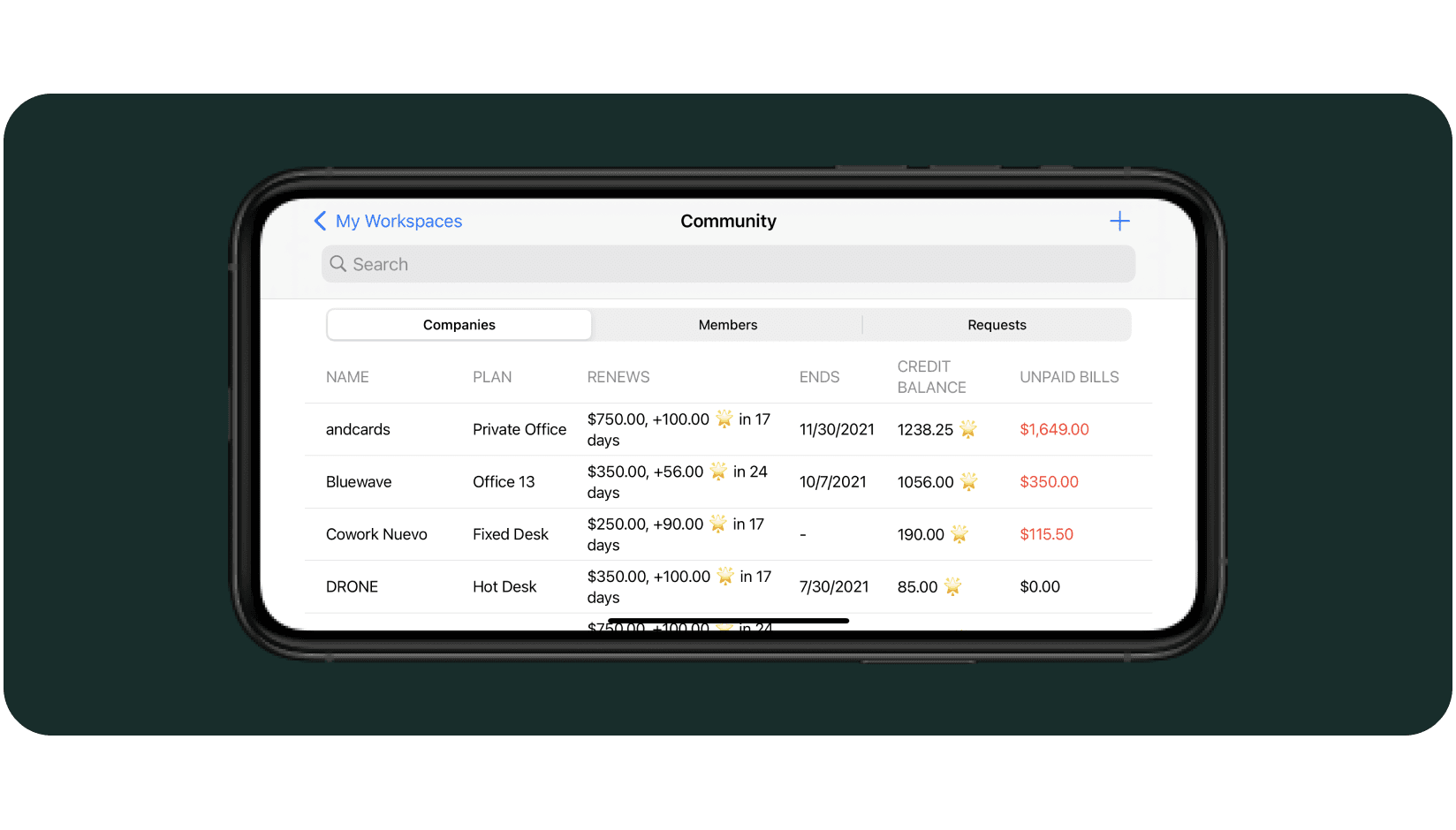

It’s really easy to review and send bills for payment. Actually, the admin does it with one tap. The community page gives the manager a nice overview of all membership plans, billing reports, and due fees, so it’s impossible to miss a payment. You even don’t need to be at your desk to edit bills and send them to clients for payments, you can do it from anywhere you are at the moment using your smartphone.

It’s easy to detect unpaid bills right from the Community page as they are highlighted with red color

After reviewing the due bill, you can choose to send it for payment. Once the payment is confirmed, the bill is automatically marked as paid both on Spacebring billing system and an integrated accounting app in case you use it.

Now let’s take a look at payment processing in detail and see how customers make payments and how easy it is for you to collect them.

Schedule a personal demo to discover how Spacebring could benefit your shared space business

One-Click Payment Experience to Customers

As we have already mentioned above, after the admin makes the bill ready for payment and clicks ‘send’, a company manager gets the bill by email. They also get a mobile push notification, reminding them to pay, which means you don’t need to do it directly. This makes payment collection much easier for community managers as they don’t have to chase members, ask them to pay, then check if they paid, and remind them to do it again.

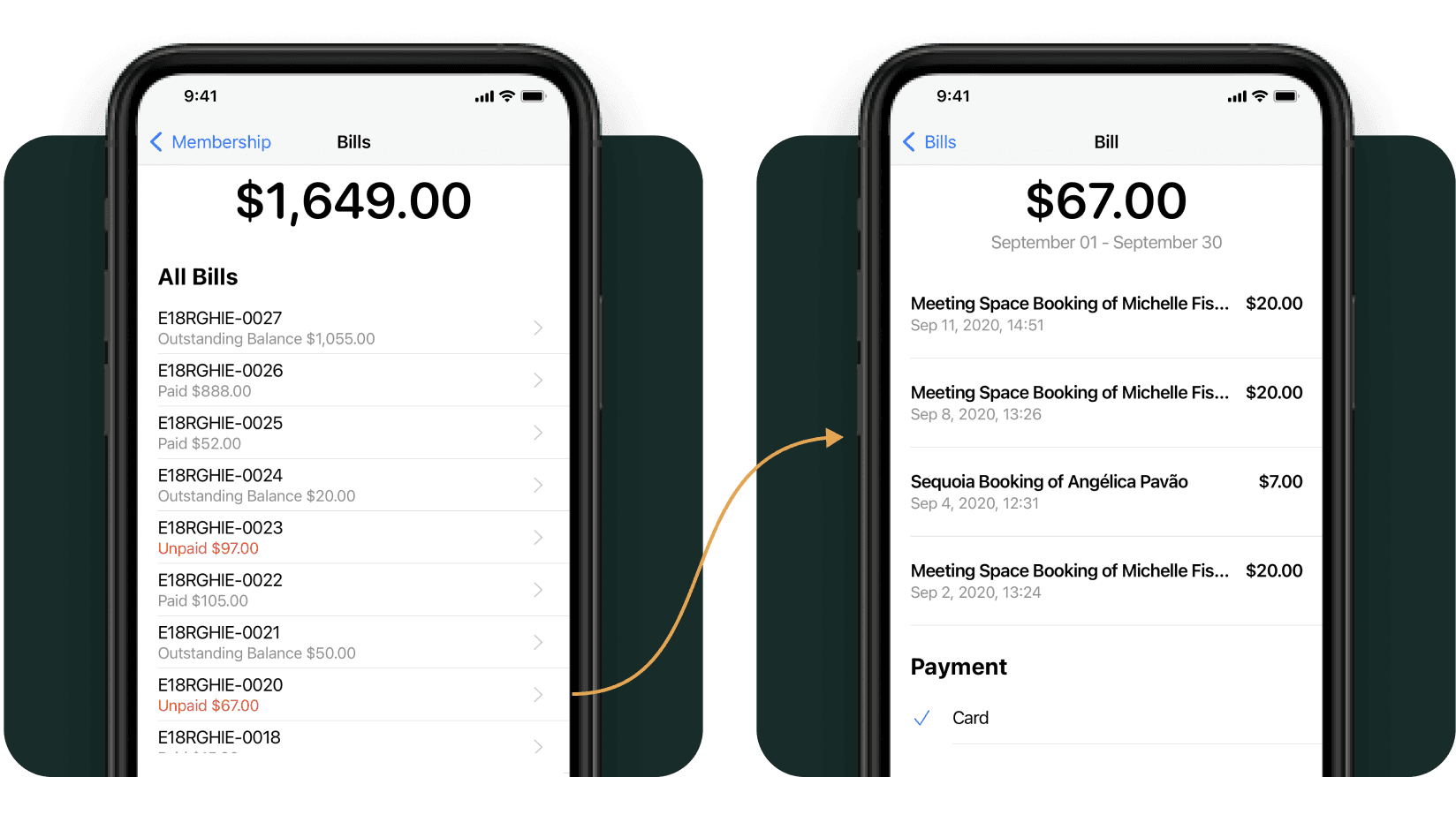

The company manager can see the entire billing history from the Membership page and review the items included in each bill

After reviewing the due bill, the company manager pays it in a click inside one and the same app they use for bookings, communication, and all other coworking space-related things. The bill is paid with familiar payment options of choice—debit cards, credit cards, Apple Pay, Google Pay, direct debit, and other local payment methods.

Side note: You don’t need to additionally configure billing options to accept instant payments by bills through your connected payment gateways.

That’s it, the cycle is looped. The money instantly gets into your account, the bill is marked as paid both on your coworking space software and accounting technology if you use it.

Automated Payments for Bills

Billing solution from Spacebring not only keeps the records of all membership fees as well as other members’ expenses, creates bills, sends them, but also allows for recurring payments to charge members for their membership plans and other services automatically.

I mean members don’t have to submit credit card details every time they need to make a payment. They do it only once. After that, their payment information is securely stored by a connected payment gateway, which makes payments really quick and effortless. With this setup, you are more likely to prevent customers from getting caught up in credit card scams and risking their personal information.

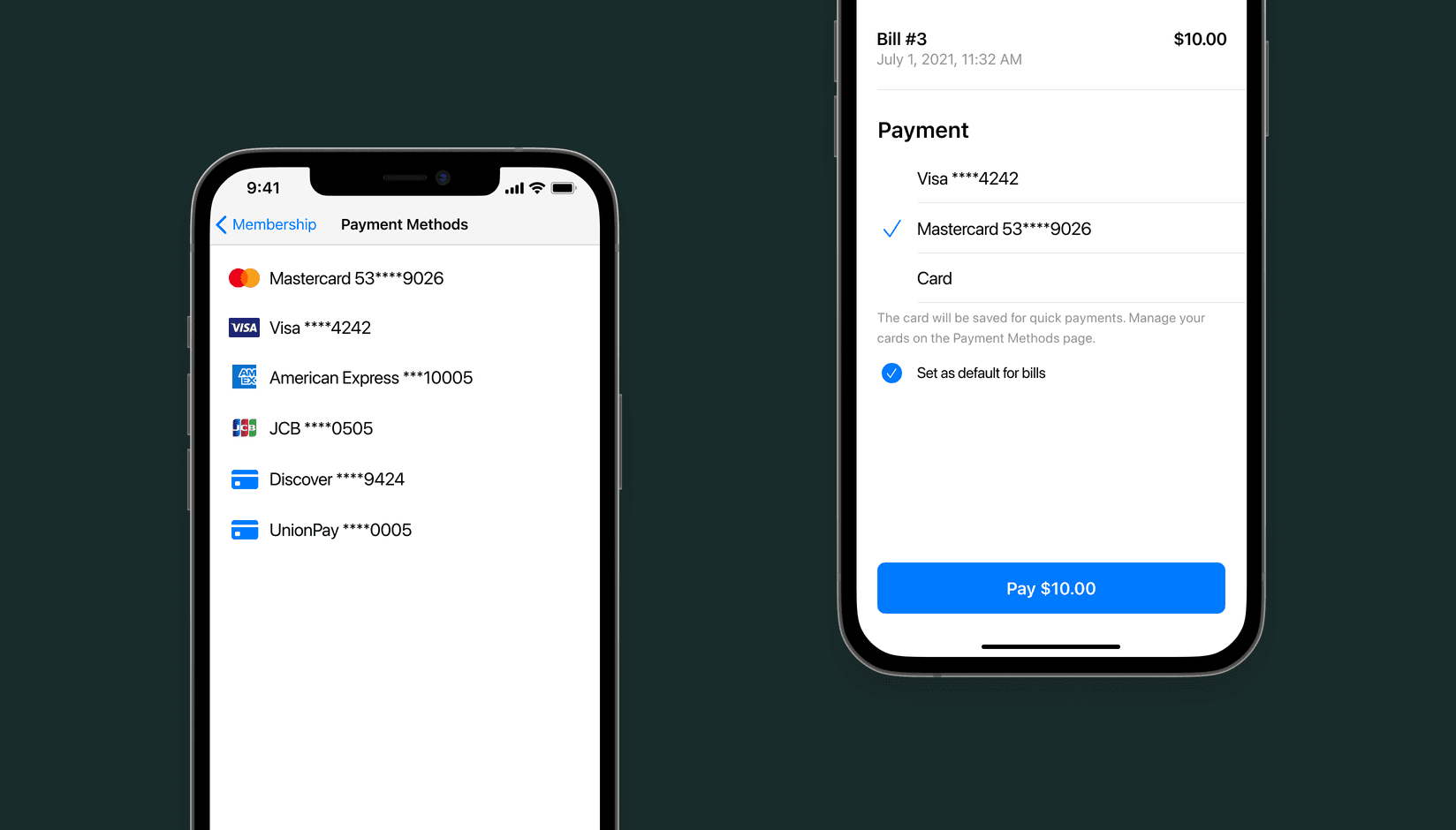

If a member is paying with a new card for a bill, Spacebring will offer to make that new card a default payment method for bills. Spacebring saves all card types supported by your payment gateway, such as Visa, Mastercard, American Express, Discover, JCB, UnionPay, and others.

With automated payments for bills, administrators are 100% free from payment collection because membership fees and other payments are charged automatically to the default payment method on file. Besides, Spacebring’ billing takes no commissions on recurring subscriptions, so you won't pay anything on top of your payment gateway provider’s fees.

Furthermore, Spacebring system can distinguish individual and company payment methods. So, a user can conveniently choose whether to pay with a company card or personal card, without having to switch accounts.

In fact, a single user can have several associated payment accounts on Spacebring, which is rather convenient. For example, if a company reimburses a desk in the coworking space for its employee but doesn't reimburse food or gym, a company manager can add both corporate and personal cards to pay for coworking space services with a preferred method.

All in all, with an automated billing system and payment for bills, the process becomes effortless for managers and user-friendly for members. Now let’s quickly recap what exactly a billing system automates for managers and members of a flexible workspace.

Benefits of an Automated Billing System for Coworking Spaces

For administrators

- Charge recurring monthly bills to companies automatically without spending much time on these everyday tasks.

- Collect payments effortlessly with automated payment for bills when membership fees and other payments are charged automatically to the default payment method on file.

- Have an overview of all past and upcoming bills to be confident that all payments are collected.

- Have full control over billing settings: manage bill items, add one-off charges, delete, or send for payment.

- Get real-time payment status updates upon a bill payment.

- Find a corresponding member and add invoice items to Quickbooks or Xero.

For company members and managers

- Get a simple way to pay for bookings, events, and services, by including all these into an upcoming bill.

- Review all coworking-related expenses in one place easily.

- Have full control over monthly expenses: company managers review upcoming bills and allow coworkers to pay by the bill.

- Pay for due bills in a simple way.

- Get push notifications with reminders of time to pay.

- Input banking card details only once. Payment information of all card types (Visa, Mastercard, American Express, Discover, JCB, UnionPay, and others) is securely stored by a connected payment gateway.

- Pay with personal and company cards without switching accounts.

To Take Away

By implementing an automatic billing solution for coworking spaces that takes care of all key components mentioned above (monthly bills, one-click payments) you can not only save the manager’s time (accountant’s salary) but significantly enhance the member experience.

When the system handles all money-related matters, your managers have nothing to do but take care of members’ happiness. Powered and encouraged by the simplicity, convenience, and accessibility of the billing solution, you can efficiently sell spaces and process payments instantaneously.

Would you like to learn more about how Spacebring transforms the process of billing for flexible workspaces? Schedule a demo call with us.

Would you like to get more tips on how to make a coworking space easy to operate? Sign up for our newsletter.

Keep Reading

Innovation Junction: a Guide to Makerspaces in Coworking Environments

Commissary Kitchens: Expand Your Coworking Offerings

The Operator's Manual for Women-Forward Coworking Spaces