- Features

- Solutions

- Pricing

- Resources

- Contact

- Book a demo

You might have heard about ACH many times but if you still don’t use it as one of the payment methods at your coworking space, it means you miss some details. ACH can benefit invoicing at your coworking space in many ways—including reducing costs, automating payments and more. In this blog post, we'll go over what ACH is and how your business can take advantage of it.

Let’s go!

What Is ACH

ACH stands for Automated Clearing House. It is a system used by financial institutions in the United States to process electronic payments. The ACH is administered by the National Automated Clearing House Association (NACHA), a not-for-profit association representing virtually all U.S. financial institutions.

ACH transactions are frequently referred to as eChecks, direct deposit, direct debit, automatic withdrawal, and more.

For Who

ACH processes large volumes of credit and debit transactions very quickly. This makes it an efficient way to move money between accounts. ACH transactions are often used by:

- Consumers to send funds between accounts

- Employers to pay their employees

- Customers to pay service providers

- Taxpayers to send funds to the IRS

- Businesses to pay suppliers

Banks & Countries of Operation

Bank of America, Chase, Citi, Wells Fargo, US Bank, PNC, etc. ACH is a very popular payment processing method, so pretty much every bank in the US uses it.

If you need to send or receive money electronically, chances are your bank will use ACH to process those transactions. If you don’t see your bank on the list, just confirm that they participate in the ACH network.

ACH network was originally built for the US but is also accepted in Canada and a number of European countries.

Types of ACH Payments

There are two types of ACH payments: ACH credit and ACH debit.

- ACH credit is when you send money to someone else. The recipient's bank will then credit the recipient's account with the amount of money that you sent.

- ACH debit is when you pull money out of the tenant's account. The funds will be withdrawn from the recipient's bank account and transferred to yours.

Is ACH Secure?

ACH is one of the most secure payment methods available. It's been used for years by businesses and consumers to make payments online. ACH payments are processed through the Automated Clearing House network, which is a reliable system used by banks to transfer funds electronically. So you can rest assured that your ACH payments are safe and protected.

Though, as no system is infallible, it's always important to take measures to protect your information. Make sure you use a strong password and keep your computer security software up-to-date.

Is ACH Fast?

It depends on the financial institution. Some banks process ACH payments immediately, while others may take a few days. However, most ACH payments are processed within 48 hours.

Benefits of ACH for Your Coworking Business

Accepting ACH is advantageous for your coworking business in many ways including the following.

- Huge savings on payment processing fees. There's no comparison between paying with a card and doing direct debiting. For instance, if you use the networks in America it will cost $87.3 for $3000 transactions but only five dollars when using ACH!

- No failed payments anymore. With 3% to 5%, card payments go wrong each month mostly because of expiry or cancellation—but not when you use a customer’s bank details! With direct debit, failure rates are less than 1% because accounts rarely expire or change. There are no transaction limits on bank accounts like they sometimes have for credit cards when you can’t charge more than $8000, for example.

- No late payments anymore. Why waste time chasing payments from members when you can just bill them directly? ACH gives you an opportunity to manage subscriptions efficiently, collect payments when they are due, and have your money on time automatically

- Insert payment details only once. The customer doesn't have to input their bank account details each time they want to pay with ACH. Just like cards, Stripe securely stores all bank account details so that members can choose their preferred method of payment when they pay by invoice.

- Go flexible worry-free. With ACH you can make changes in members' payment plans quickly and easily. Change the amount and frequency of payments without having to require re-authorization from customers. This saves you time, hassle or both!

Any Downsides?

Even the sun has spots, so there are a few drawbacks to ACH payments.

- You don’t get your money immediately. ACH transfers can take a bit longer to process than credit or debit card payments—usually two to three business days, as opposed to just a few seconds for card payments.

- Harder to resolve payment issues. Another potential downside is that if there's an issue with the payment (e.g., it was sent to the wrong account), it can be more difficult to resolve than if there's a problem with a card payment.

Discover how hundreds of spaces worldwide unlock success and grow better with Spacebring

How to Accept ACH Payments at Your Coworking Space

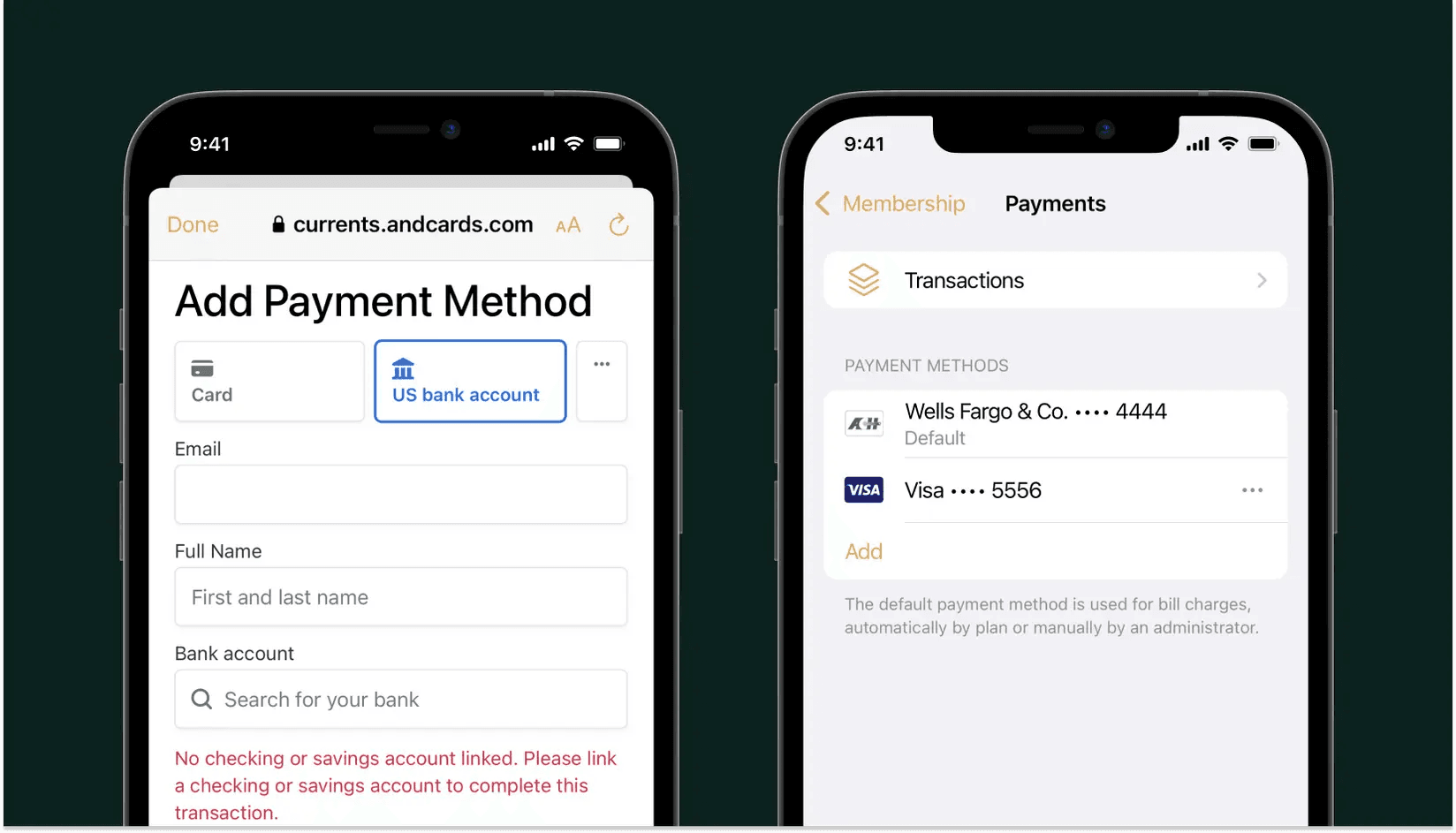

For Spacebring customers it is really easy to start accepting ACH payments. The platform’s powerful billing automation allows spaces to generate invoices and collect payments through bank cards such as Visa and Mastercard. When tenants move in, you just assign a membership plan and Spacebring takes care of invoices and payment collection.

In addition to cards, users can connect their bank accounts for payment settlement. The process of adding an account is as easy as adding a card. When the account is connected, you will be able to charge it in a click, just like you do with members’ cards.

The feature is free to use on Spacebring side. Unlike other coworking management systems, Spacebring doesn’t charge any commission from customers for connecting or using ACH direct debit payments. You pay only Stripe’s payment processing fees that depend on the country but stay really low compared to cards.

Not an Spacebring customer yet? Schedule a one-on-one demo with our product expert to see how the system matches your unique use case.